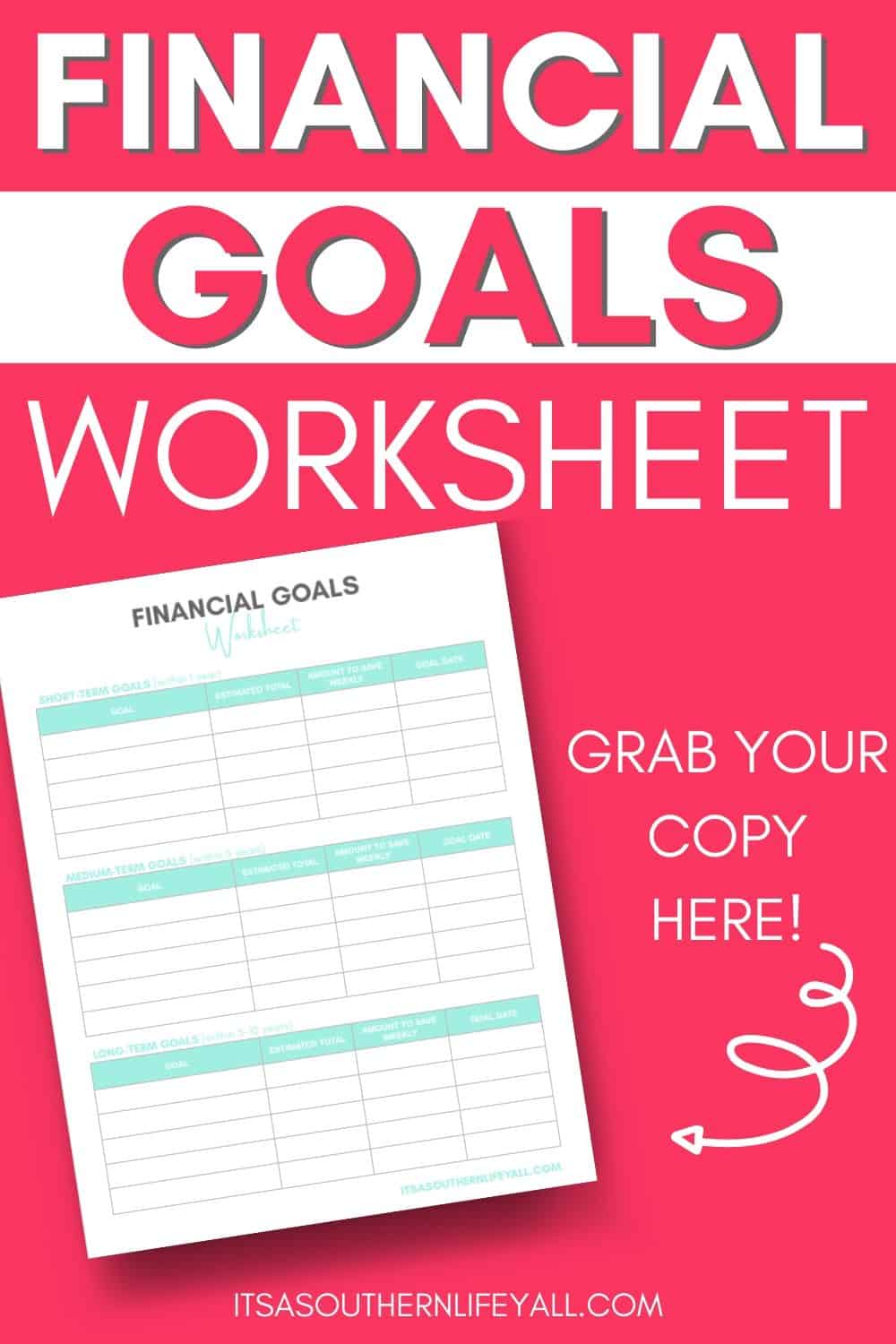

Do you have financial dreams or do you have financial goals? Not sure of the difference? A dream is a wish whereas a goal is a plan. Making things happen takes planning, patience, and control. Using the financial goals worksheet will help you plan a healthy financial future.

(This post may contain affiliate links. What does that mean to you? Well, if you click on a product and make a purchase, I may receive some compensation at NO charge to you. If you want to read the boring stuff, my full disclosure can be found here.)

Setting smart financial goals help teach you to be responsible with your money. It will also give you a clear vision of what you need to do to get to the desired point.

Where it’s saving for a vacation or a down payment on a home, setting goals is making a plan to get you there.

Learning how to set financial goals is a big step in planning your future.

How to Set Financial Goals

- Make a list of your goals and determine your priorities.

- Distinguish your short, medium, and long term goals.

- Write it all down and create a solid plan to achieve your goals including deadlines.

- Reevaluate your goals from time to time to see if your budget and/or needs have changed.

How to Use the Financial Goals Worksheet

List Your Goals

As you list your goals you will see that some will take longer than others. Some goals, although large, you might want to do in a smaller time frame. Take the time to rank your goals into short, medium, and long term goal categories.

Having a hard time distinguishing between your goal categories? Let me break it down for you and give you some examples.

Short-Term Goals

Short-term goals are for your more immediate expenses and should be completed in a year or less.

- Emergency fund

- Minor home repairs

- Appliances/Electronics

- Travel

- Wedding

Medium-Term Goals

You may find determining your medium-term goals a little more difficult. These goals generally take 1-5 years to complete and may seem like a long-term goal in some cases.

- Buy a car

- Pay off debt

- Save for a down payment

Long-Term Goals

When you think long-term you should look at life’s big picture. This is an area many people forget or feel unobtainable. These goals take over 5 years (and sometimes decades) to reach.

- Retirement fund

- Saving for college

- Paying off your mortgage

- Starting a business

Estimate the Cost of Each Goal

This step takes a little work and research to figure out how much is needed for each goal. Some things will be simple because it is simply the cost of an item. Other goals, an emergency fund, for example, are more discretionary.

Calculate Your Weekly Savings

To discover the weekly amount needed for each goal, divide the estimated cost by the number of weeks until your goal date.

Visit Your Budget

Do you have enough room in your budget to make your goals a reality? Take the time to see if you can cut some costs and rework your budget to help you achieve your financial goals.

Sometimes it’s necessary to take a good hard look at your expenses and decide if your spending is on track with where you want to be.

Do you have a budget? Creating a budget is a crucial step in having a healthy financial future.

Making hard decisions will help you put your plan into action.

Leave a Reply