How To Create A Christmas Budget

“Maybe Christmas” the Grinch thought, “doesn’t come from a store.” “Maybe Christmas,…perhaps…means a little bit more.” – Dr. Seuss

Did you know that Americans are anticipated to spend $720 billion this year for Christmas? The average family will contribute $1007.24 to this total. Whoa! That’s a lot of cozy socks, popcorn cans, and fruit cakes!

Unless you’re living under a rock and completely skipping Christmas and holiday shopping, you’ll play a part in this holiday spending frenzy. In the effort to avoid the holiday financial hangover, now is the perfect time to create a Christmas budget.

But unless you want blue Christmas, creating a Christmas budget is only the first step…

You must also stick to it.

(This post may contain affiliate links. What does that mean to you? Well, if you click on a product and make a purchase, I may receive some compensation at NO charge to you. If you want to read the boring stuff, my full disclosure can be found here.)

Do you plan your Christmas spending or do you just fly by the seat of your pants when you are Christmas shopping and regret it later?

Creating a Christmas budget can help you manage your holiday spending. It’ll also keep you in check knowing where all of your money is going.

But don’t let the word BUDGET scare you off. Creating your Christmas budget doesn’t have to be a hard or complicated process. Here you’ll find the steps to create a basic holiday budget to help you manage your spending.

How to Start your Christmas Budget

1. How much do you plan to spend?

Although on average Americans plan to spend around $1000 during the Christmas season, you’re not obligated to keep up with the Joneses. Your holidays shouldn’t be built around the notion of spending money.

Christmas is about so much more.

With that being said, setting your spending limit is a must when you are managing your personal finances. This amount is determined by how much you can afford, the amount you have saved, and if you have any wiggle room in your existing budget.

So let’s crunch your numbers and set an amount you can live with.

Once you’ve determined your dollar amount, it’s time to get into where you plan to put that money…gifts and other expenses.

As you start making your budget, you might see that you have to work your numbers a few times to get everything to fall into place perfectly. Don’t get discouraged. Just keep plugging in the numbers until you find the sweet spot where everything works.

So let’s grab some paper and your favorite beverage and get to work.

RELATED POST: Ridiculously Easy Ways to Make Money for Christmas

2. Gift Budget

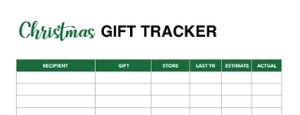

Grab your free copy of the Christmas Gift Tracker below and let’s tackle your gift-giving first.

Now once you have the gift tracker, list everyone you want to buy a gift for this year. Don’t think too hard about this, just list everyone…you can edit this later.

After you have your list created, if you know what you spent last year, fill in that column. This will help you have an idea of how much you can spend if your budget is about the same as it was last year. If your budget is a little less or a little more, you can make those adjustments as you are allocating all of your budgeted funds.

Now you can tackle the estimate column of how much you would like to spend on each person this year. After you go through your entire budget, you might have to visit this column again to make adjustments.

3. Other Christmas Budget Items

On a separate page (on the back of the gift tracker is fine), list ALL of the other things you need money for during the holiday season.

Items you should include:

- Christmas tree

- Food

- Wrapping supplies

- Travel

This list should include anything Christmas related that isn’t a gift.

These are often the forgotten budget items. But we can’t forget them because they’re out of the norm expenses for you.

4. Add It Up

Now add it all up and see if this total is in line with what you plan to spend this Christmas.

If it’s not, go back and see what you can remove from all of your expenses to make your budget work. This might take a few tries to get it all to work perfectly but once you have set your budget and have your shopping list in sync, you will breathe a sigh of relief.

5. Where Is The Budgeted Money Coming From?

So you know what you need but do you know where this money is coming from? Have you planned and set aside funds to pay for the holiday season?

It’s not too late (nor too early) to start saving for Christmas. If you started saving now, you could stash away some serious cash to help with your Christmas expenses. It might take some tightening of the already tight belt but it’s doable.

I decided years ago to live a debt-free Christmas life. That’s why I’ve created the Debt-Free Christmas Workbook. This workbook helps you create a plan to keep you from overextending yourself financially over the holiday season.

Living with a Christmas budget cash-only system has taken so much of the holiday stress from my shoulders. It allows me to jingle all the way through the season because I know I won’t receive an astronomical credit card bill in January.

In all honesty, it wasn’t easy when I first decided to have a debt-free Christmas. But with the proper planning, I’ve come to LOVE knowing I have the cash to cover all of my holiday expenses every year.

Click the image below to learn more!

Creating a Christmas budget can be your financial lifesaver this holiday season. Knowing where you intend your money to go and sticking to that plan is essential when you want to avoid the holiday financial hangover that happens in January.

Learning to live within or below your means is a big step in creating a life of financial freedom.

RELATED POST: Half Payment Budget Method

Leave a Reply